We're thrilled to extend an exclusive offer to our Maryland Society of Accounting & Tax Professionals (MSATP) members. This is your chance to join the...

Take control of your financial reporting with our course on Chart of Accounts and Custom Reports in QuickBooks Online! In this 100-minute session, we'll walk...

Unlock the power of QuickBooks Online's bank feeds and reconciliation features! In this 100-minute session, you'll learn how to seamlessly connect your bank...

This essential course is crafted to equip solo practitioners and small firms with the latest knowledge and best practices in cybersecurity. As the threat...

This course, presented by experienced attorneys, will address tax controversy issues when dealing with collection alternatives, audits, Earned Income Tax Credit...

Upon completion of this course you will be able to explain the basic structure of the system to clients and provide them with additional resources they can use...

We know how lonely owning a practice can be. Staying on top of regulations, managing client communications, working long hours, trying to figure out the best...

We know how lonely owning a practice can be. Staying on top of regulations, managing client communications, working long hours, trying to figure out the best...

We know how lonely owning a practice can be. Staying on top of regulations, managing client communications, working long hours, trying to figure out the best...

The Kaiser Family Foundation now reports that over 50% of all working Americans are covered by Health Savings Accounts. This course provides detailed knowledge,...

We know how lonely owning a practice can be. Staying on top of regulations, managing client communications, working long hours, trying to figure out the best...

Join us for an enchanting evening where we will explore an array of Linganore's exquisite wines, guided by their knowledgeable staff. It's a fantastic...

Essential for today's hybrid and remote working environments, this course covers effective management of remote accounting teams, including communication...

Become an expert in knowledge and practice of retirement investment taxes, including changes from Secure Act 2.0 legislation with the 3-credit-hour IRA’s,...

This one-hour course is crafted for solo practitioners and owners of small accounting and tax firms who aim to enhance their business operations through...

Essential for leaders facing industry changes, this course covers managing and leading through change, including technological advancements, regulatory changes,...

The course reviews depreciation in general and then explains basis, lives and methods. It is followed by detailed discussions of Sec. 179, bonus and luxury...

Focuses on building and nurturing high-performing teams. Topics include talent acquisition, effective team management, performance evaluation, and professional...

Join us for our "Coffee & Conversations" morning, a relaxed yet invigorating gathering designed specifically for accounting and tax professionals in Maryland....

We know how lonely owning a practice can be. Staying on top of regulations, managing client communications, working long hours, trying to figure out the best...

We know how lonely owning a practice can be. Staying on top of regulations, managing client communications, working long hours, trying to figure out the best...

Join us for a day of empowerment, learning, and networking with some of the most inspiring women leaders in finance. Whether you're a seasoned professional or...

Join our CPA Exam Study Group, led by the highly experienced and passionate CPA exam coach, Nicole Winston, CPA. This study group is designed to provide you...

In this presentation author and Excel expert David Ringstrom, CPA, helps you expand your Excel toolbox by comparing the INDEX/MATCH functions to the XLOOKUP...

Introducing the most useful accounting course you’ll ever attend: Preparations, Compilations, and Reviews! This ultra-practical course is full of up-to-date...

Review new FASB Pronouncements up to the date of the course. This presentation will inform participants of the latest issues from the FASB and the Private...

The Maryland Society of Accounting and Tax Professionals is excited to offer a special member benefit demonstration on Verifyle Platinum, included for free with...

Give the very best tax advice to your individual and small business clients with TaxSpeaker’s newly updated planning guide! This course is designed to guide...

This foundational course is designed to introduce accountants and tax professionals to the world of digital assets. It covers the basics of what digital assets...

This course provides a comprehensive look into the Maryland Saves Program, focusing on the key elements essential for accountants advising clients who may...

Part of our Pour & Explore Dinner Series, designed exclusively for tax professionals. This unique event combines the pleasure of dining with the enrichment of...

This course delves deep into sophisticated tax planning and optimization strategies to empower real estate professionals with the knowledge to navigate the...

A course tailored specifically for accountants, CPAs, and tax professionals who provide services to clients in the salon and spa industry. This comprehensive...

Join us for the Business Builders Connection Conference, a remarkable event designed exclusively for small and solo firm members in the accounting and tax...

Join us for the Business Builders Connection Conference, a remarkable event designed exclusively for small and solo firm members in the accounting and tax...

This course focuses on the taxation aspects of digital assets. It provides in-depth knowledge on how different types of digital assets are taxed, reporting...

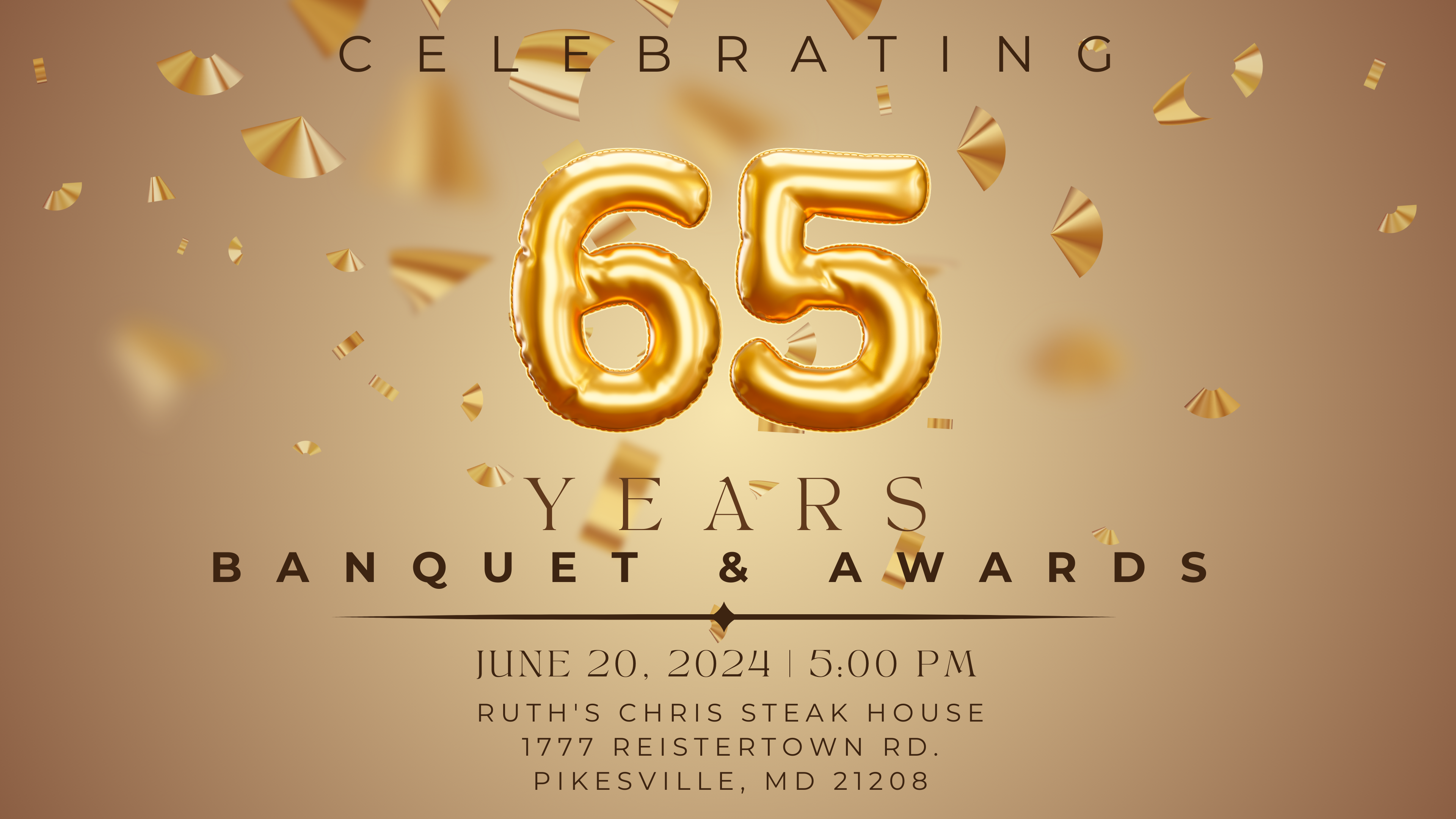

Join the Maryland Society of Accounting and Tax Professionals (MSATP) for an evening of commemoration and camaraderie at our Annual Banquet, immediately...

Although artificial intelligence seems like it is suddenly permeating every aspect of our daily lives, AI has been part of Excel for over a decade now. In this...

This lunch & learn offers a comprehensive look at the critical components of a Written Information Security Program (WISP) and practical steps for its effective...

This course examines and addresses the conduct standards within Circular 230. The instructor will present topics on rules governing authority to practice, fees...

This 4-hour course is designed to meet the 4-hour professional ethics CPE requirement for Maryland CPAs. It provides an overview of ethical thought along with...

This course is designed for accountants and tax professionals who specialize in or wish to expand their expertise to the restaurant and brewery sectors. This...

We know how lonely owning a practice can be. Staying on top of regulations, managing client communications, working long hours, trying to figure out the best...

Join our CPA Exam Study Group, led by the highly experienced and passionate CPA exam coach, Nicole Winston, CPA. This study group is designed to provide you...

Tax professionals serving the cannabis industry face unique challenges due to its regulatory landscape. This presentation offers tailored guidance to assist...

This course offers an introduction to the burgeoning field of cannabis accounting. Given the industry's unique legal complexities and rapid growth, there's a...

Join our CPA Exam Study Group, led by the highly experienced and passionate CPA exam coach, Nicole Winston, CPA. This study group is designed to provide you...

Join us for a focused, two-hour course on the latest developments in payroll regulations tailored specifically for Maryland businesses. "Payroll Compliance...

United States taxpayers with multinational activities face potential exposure to double taxation - from the source country for the income item and the United...

This course is intended to review the Federal Tax Code (IRS) rules for deducting travel and entertainment expenses related to businesses, with a focus on new...

Navigate the complexities of reporting foreign business interests with our comprehensive two-hour course. Designed for accountants, CPAs, and tax professionals...

Step into a world of joy and camaraderie at our exclusive gathering – it's time to embrace the true essence of Happy Hour! Join us for an epic extravaganza...

Congress and the IRS never cease modifications to what we know of the formation and operation of C corporations, LLC’s, and S corporations. TaxSpeaker® is...

Congress and the IRS never cease modifications to what we know of the formation and operation of C corporations, LLC’s, and S corporations. TaxSpeaker® is...

Although we would like to work our entire career without discovering illegal or unethical behavior in our organization there is a high probability that at some...

Step into a world of joy and camaraderie at our exclusive gathering – it's time to embrace the true essence of Happy Hour! Join us for an epic extravaganza...

Congress and the IRS never cease modifications to what we know of the formation and operation of C corporations, LLC’s, and S corporations. TaxSpeaker® is...

Congress and the IRS never cease modifications to what we know of the formation and operation of C corporations, LLC’s, and S corporations. TaxSpeaker® is...

This intensive 2-hour course is tailored for tax preparers who wish to deepen their understanding of Maryland's Inheritance Tax laws and regulations. The course...

This course will review the basics of the financial statements, the balance sheet, the income statement, and the statement of cash flows. We will discuss...

Step into a world of joy and camaraderie at our exclusive gathering – it's time to embrace the true essence of Happy Hour! Join us for an epic extravaganza...

Step into a world of joy and camaraderie at our exclusive gathering – it's time to embrace the true essence of Happy Hour! Join us for an epic extravaganza...

Our 1,100 page course manual supports the Form 1040 with TaxSpeaker’s® 1040 Tax in Depth course! Our 2024 course will include detailed coverage, with...

Our 1,100 page course manual supports the Form 1040 with TaxSpeaker’s® 1040 Tax in Depth course! Our 2024 course will include detailed coverage, with...

EARLY BIRD PRICING $100 per person until June 30, 2024 The Third Annual Holiday Soirée promises to be an unforgettable night of joy, laughter, and...

It is often necessary for accountants to assist their employer or client with bankruptcy issues. This course is designed for accountants who are working with or...

Step into a world of joy and camaraderie at our exclusive gathering – it's time to embrace the true essence of Happy Hour! Join us for an epic extravaganza...

This no-frills course has been designed to review all changes affecting for-profit taxpayers, combining the individual update with the business update without...

This no-frills course has been designed to review all changes affecting for-profit taxpayers, combining the individual update with the business update without...

Our 1,100 page course manual supports the Form 1040 with TaxSpeaker’s® 1040 Tax in Depth course! Our 2024 course will include detailed coverage, with...

Our 1,100 page course manual supports the Form 1040 with TaxSpeaker’s® 1040 Tax in Depth course! Our 2024 course will include detailed coverage, with...

Step into a world of joy and camaraderie at our exclusive gathering – it's time to embrace the true essence of Happy Hour! Join us for an epic extravaganza...

Our 1,100 page course manual supports the Form 1040 with TaxSpeaker’s® 1040 Tax in Depth course! Our 2024 course will include detailed coverage, with...

Our 1,100 page course manual supports the Form 1040 with TaxSpeaker’s® 1040 Tax in Depth course! Our 2024 course will include detailed coverage, with...