#TechTips – Aristotle’s Square of Oppositions

Picking up the thread of discourse from our previous entry, we continue on our tour of the disciplines of Philosophy, with our first stop being on the matter of logic. We briefly covered Aristotle and his famous work, “De Interpretatione” in our last post.i

In this book, the great thinker laid down his observations about affirmations, negations, oppositions, and contradictions through the use of certain key words including, ‘all’, ‘no’, ‘some’, and ‘not’.

As stated in the previous post, later scholars would take this work, particularly in chapters 6-7, and set forth a diagram we know today as the ‘Square of Oppositions’. Some of you may be familiar with the premise that ‘All men are mortal. Socrates was a man. Therefore, Socrates was mortal.’ and similar constructs. This is the foundation of logic.

We will now delve into the Square of Oppositions as it formed the basis for western thought for some 2,000 years. Even though we in this modern age have moved beyond the square, and that after 2,000 years the square had become a hinderance to our thought process, we must start our journey here because of its historic importance.

Imagine what it must have been like for these early thinkers. What we think of as our inner voice, or subtext, these people must have thought as if they were hearing literal voices in their heads. Aristotle’s work, in this context, is a monumental achievement and a testament of the human potential to rise above our humble beginnings.

To put this idea into some context, Aristotle is roughly halfway between the civilization that built the Sphynx, estimated to be about 4,500 years old, and our modern age. It took humanity at least 2,100 years to get to a point where we could begin our journey into that most complex creation in the entire universe, the human brain.

Now to the square.ii

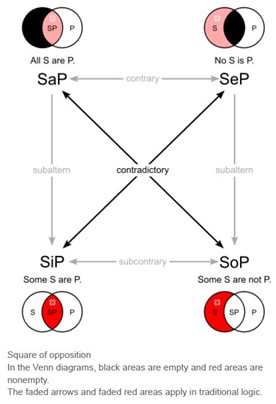

We start with the four Aristotelian Propositions:

- All S are P

- No S are P

- Some S are P

- Some S are not P

Mapped out on the square we can see that if one proposition is true, then it’s contradictory proposition cannot be true.

For example, all tax laws make sense may be true (ostensibly, but that would be a subject for metaphysics – that was a tax joke.) And if all tax laws make sense is a true statement, then it is not possible for the statement that no tax laws make sense to be true as well. In this case, either they all make sense, or they all don’t make sense.

Propositions that use the word ‘all’ or ‘no’ are referred to as the Universal Positive or Universal Negative, respectively.

Moving to the more ambiguous propositions containing the word, ‘Some’, we can see complexity.

If some tax laws make sense, it is also possible for some tax laws to not make sense, BUT, if some tax laws make sense and some tax laws do not make sense, then it is not possible for no tax laws to make sense any more than it is possible for all tax laws to make sense.

Ok, if your head is spinning, let’s bring this back to our real world.

If a client incurs an expense and they want to deduct it and they are a sole proprietor, then that expense must be both ordinary and necessary. This construct from IRC Sect 162 sets forth a proposition that is a universal positive for this expense in question. If the expense is ordinary, but not necessary, it can’t be deducted. If the expense is necessary but not ordinary, it can’t be deducted. If the expense is neither ordinary nor necessary, it cannot be deducted. Only the universal positive allows for the deduction – but there’s more to it, because this is tax.

The expense must be both ordinary and necessary, and properly documented with a receipt of some form.

Now we can expand the scope of our logical analysis further. All expenses that are ordinary and necessary may be deductible under IRC 162, but only if they are properly documented. If all expenses that meet the requirements of IRC 162 are properly documented, they can be deducted. If none of the expenses are properly documented, they cannot be deducted. If some of the expenses are properly documented, some of the expenses can be deducted. If some of the expenses are not properly documented, then some of the expenses cannot be deducted. (Yes, I know about the Cohen Rule, but honestly, if you’re relying on that, you might as well go hunting murder hornets without safety gear – an act that is profoundly illogical.)

We know this intuitively. But think about it. There was a time when this kind of thought process was new, and people were in awe of this conceptual framework. I wonder what they’d make of Twitter.

With all that said, we still have to explain to people that while they may indeed have blank checks in their checkbook, they don’t necessarily have funds in their checking account. Not all properly endorsed checks can be successfully transacted through the bank. Some properly endorsed checks will not be able to be successfully transacted through the bank due to non-sufficient funds. What is logical to us is magical to some.

Likewise, paying for an item on a credit card doesn’t mean it’s free. But before you try and explain that logic to your client, perhaps it might help to drink something strong, just to get in the proper frame of mind. (Just don’t drive after you’ve imbibed.)

Try forming a proposition on your own. Think of a subject and a predicate and see how they relate. One thing to remember in this exercise is that in order for your proposition to meet the standard of logical validity, the construction of the premises must be correct, AND the subject and predicate must be factual. All men are mortal. Socrates was a man. Therefore, Socrates is mortal.

Here’s one:

Tech Tips covers technology for the accounting profession. Xero is a piece of technology for the accounting profession. Therefore, Tech Tips covers Xero.

Here’s another:

Tech Tips loves preparing tax returns. Tax returns are a lot of fun to prepare. Therefore, Tech Tips has fun while preparing tax returns.

So, that second one…not logically valid. One of those premises is not factually correct (guess which). If at least one of the premises is not factually correct, the conclusion cannot be correct.

Here’s another:

Tech Tips loves spicy foods. Spicy foods can be healthy. Therefore, Tech Tips pops TUMS like candy.

This one is not logically valid either, even though both premises are factually correct, the logical construction is not valid. To workshop that 3rd premise, the premises must be related in some way.

Tech Tips loves to eat spicy foods. Eating spicy foods cause Tech Tips to experience heartburn. Therefore, Tech Tips pops TUMS like candy.

Or…Tech Tips loves to eat spicy foods. Spicy foods can be healthy. Therefore, Tech Tips eats healthy.

This last version is technically valid, but it highlights the limits of Aristotelian logic. It’s binary, linear, constrained. It can’t capture the complexity of the world we inhabit today, but it’s a good place to start the journey because it gives us our origin. And for every journey, we need two points, an origin and a destination.

Now, that we’ve had a brief (trust me, this is very brief) introduction to logic, we’ll next turn our attention to the field of epistemology.

Fun!

We’d like to hear from you! Please submit your own tech tips to us! We will award a free subscription to The Tax Book to the person who submits the best tip. Please submit your tips to this email address: techtips@msatp.org

Thanks, and catch you next time!